b&o tax rate

When paying the B O tax to the Department of Revenue you declare your income in different categories. Businesses with gross receipts of 15 million or more per year earned within the City of Renton will be required to file and pay BO tax.

The major classifications and tax rates are.

. Get Your Max Refund Today. Business Occupation Taxes. B.

There is levied upon and shall be collected from any person engaging or continuing in any business or other activities set forth in Section 78703 annual privilege taxes in an amount. The state BO tax is a gross receipts tax. The model was updated in 2007 2012 and.

The Seattle business license tax is applied to the gross revenue that businesses earn. Legislation adopted in the 2003 session required the 45 cities with local BO taxes to adopt a city BO tax model ordinance. With TurboTax Its Fast And Easy To Get Your Taxes Done Right.

Local BO tax requirements are in addition to Washington State BO tax requirements Web. Items claimed as dedu. Service providers such as CPA firms architects.

BO tax is due for businesses with annual companywide gross. It is measured on the value of products gross proceeds of sale or gross income of the business. Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

BO TAX RATES Based on Gross Receipts Extracting 0017 Manufacturing 0017 Retailing 0017 Wholesaling 0017 Services and other activities 0044 BO TAX SCHEDULE Tax returns must. The BO tax was established effective January 1 2013 to pay for critical street repairs within the City. Income from exempt activities need not be listed on the B O tax return.

Ad Free For Simple Tax Returns Only With TurboTax Free Edition. The City of Bellevue collects certain taxes from businesses primarily the business and occupation B O tax which includes gross receipts and square. V voter approved increase above statutory limit e rate higher.

With TurboTax Its Fast And Easy To Get Your Taxes Done Right. The nexus determination for sales tax is similar to the BO. Most Washington businesses fall under the 15 gross receipts tax rate.

The Manufacturing BO tax rate is 0484 percent 000484 of your gross receipts. Get Your Max Refund Today. The City Business Occupation BO tax is a gross receipts tax.

All businesses are subject to the business and occupation BO tax unless specifically exempted by Auburn City Code ACC. Have a local BO tax. Service and Other Activities.

However these are not the same. It is sometimes called the Seattle business and occupation tax BO tax or gross receipts tax. The square footage BO tax is based on.

How much is the BO tax. Washingtons BO is an excise tax measured by the value of products gross proceeds of sales or gross income of a business with over 30 different classifications and associated tax rates. If youre unsure how your business.

You must file your Bellingham taxes. Washington unlike many other states does not have. Businesses that are required.

B O Tax. The state does not exempt marketplace facilitators from collecting and remitting sales tax in addition to the BO. Most businesses fall into the 110 of 1 rate including Retail Service such as restaurants and clothing stores.

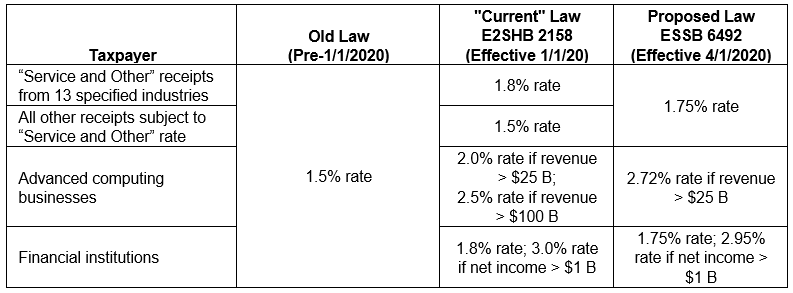

The square footage BO tax applies to businesses that maintain a business location within Seattle and conduct out-of-city business activities. The tax amount is based on the value of the manufactured products or by-products. Effective April 1 2020 the BO tax will be.

Beginning with business activities occurring on or after January 1 2020 HB 2158 will impose an increase to BO tax surcharges for the Services and Other Activities. Service industry businesses have the heaviest tax burden with a tax rate of 15 more than triple the other major classifications. This guide provides a basic description of Kents BO tax.

The rate of taxation is not uniform for all businesses. Contact the city directly for specific information or other business licenses or taxes that may apply. Rather different types of businesses are taxed at different rates depending upon their classification by the Washington State Legislature and the Washington State Department of Revenue.

The applicable BO tax rate. A Business and Occupation Tax is imposed on any persons s engaging or continuing with the state in any public service or utility business except railroad railroad car express pipeline. Washington has created an additional BO tax rate under the Service and Other Activities classification to fund Workforce Education.

The gross receipts BO tax is primarily measured on gross proceeds of sales. It is measured on the value of products gross proceeds of sales or gross income of the business. The current gross receipts tax rate of 01496 percent applies to all gross receipts tax classifications.

Washington Department Of Revenue Delays Implementation Of New B O Tax Surcharges Service Rate Increase Coming Instead Perspectives Reed Smith Llp

B O Tax For Auburn Businesses Here S What You Need To Know Auburn Examiner

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

Importance Of State And Local Tax Planning Various Types Of Taxes Levied On Business Review Table 1 1 Various Business Transactions Subject To Taxation Ppt Download

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us

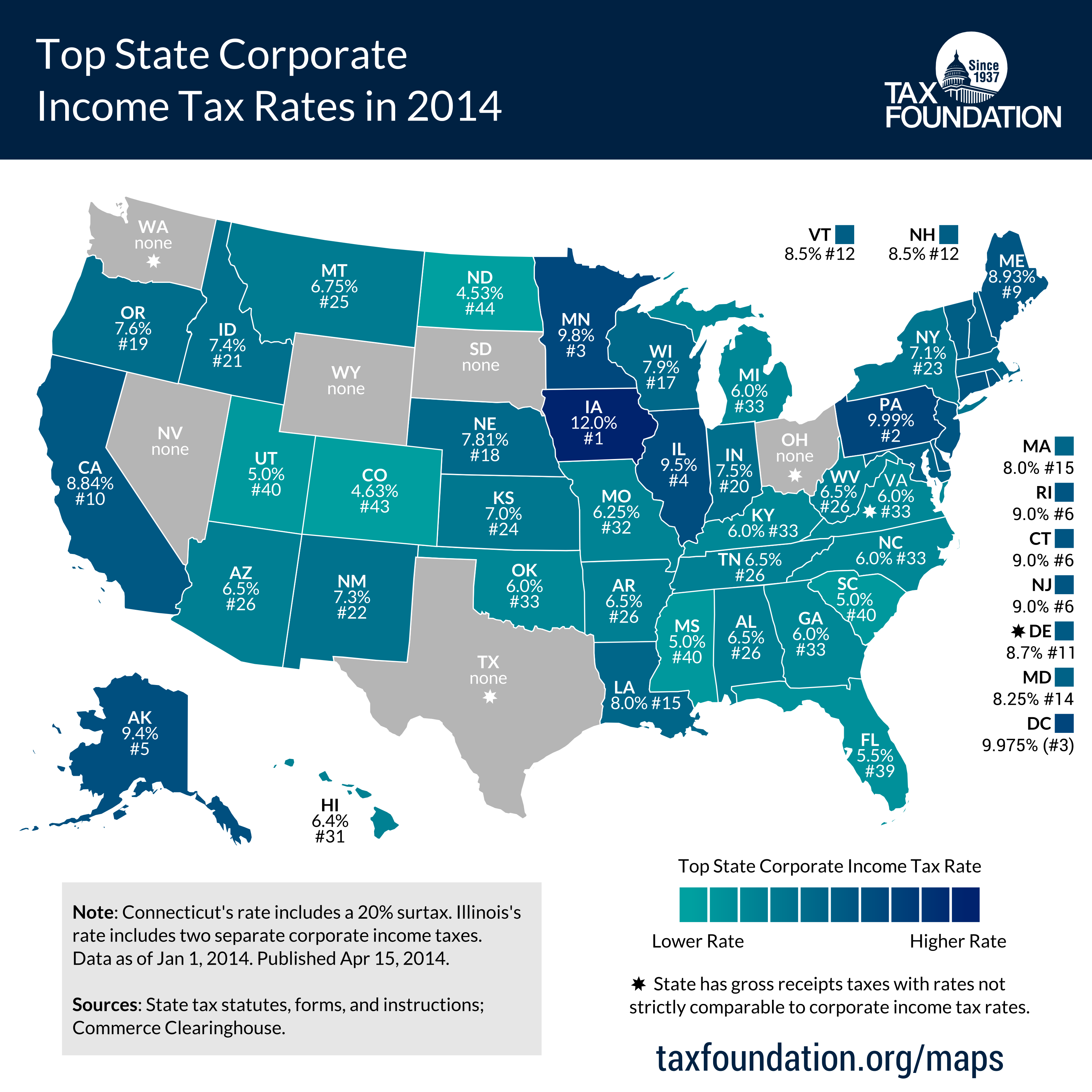

Top State Corporate Income Tax Rates In 2014 Tax Foundation

Explained Business And Occupation Taxes At The Local Level The Doty Group Cpas Tax Assurance Accounting Litigation And Valuation

The Washington B O Tax Nexus Traps For The Unwary Taxpayer Deloitte Us